The stock market is one of the biggest financial planning. You should improve your financial level as well as a business within a short period. Stock Trading is a simple process you canselland buy the stocks on daily basis. It is essential for every business even small and large businesses. With the help of many stock software, it is aconvenient way to earn more money. The gains fully depend on your luck as well as the type of trading. There are millions of people invest their amount in the share market.

Steps For Trade Stocks

The trading stock is a simpleprocess. For beginners, free stock trading online is acomplex one. So you should follow the below steps you can easily invest funds in the share market.

Step 1: fist you should open a brokerage account. It is used to hold your investment. You can open the online account with the help of the online broker. You can close attention to the costs of each trade.

Step 2: you must set a Stock Trading budget. It is a very important factor in trading. You have at leasta few amounts for your emergency.

Step 3: After completion of the above process you can use the online trading website and place your stick trades.It is consists of two order types oneis market order and another one is a limit order.

Step 4: you should set up a practice with a share trading account. With the help of the online stock brokers, the investors can get the virtual trading tool.

Step 5: finally you must calculate your returns. This advice is very important for all types of investors.

Step 6: and then you should keep your perspective. You should minimum have thousands of professional traders.

Theabove process helps to trade your share. You can follow this step when before investing your funds.

Conclusion

If you want to choose one of reliable stock platforms, you choose Webull as it always provides the best customer service to their investors. It will never need any extra commission and charge for trading. Webull.com is equipped with innovative technology and features. Millions of users will use this website compared to the other platforms. With the help of that, you can know the information about your trades immediately. It is available 24/7.So you can use this at anytime and anywhere. Webull IRA Available Now, Open roth ira or traditional ira, rollover ira Now! Deposit the required amount into your IRA and you can earn up to $1,500 in gift cards! New Webull users will have 45 days from registration to complete the deposit tasks and be rewarded.

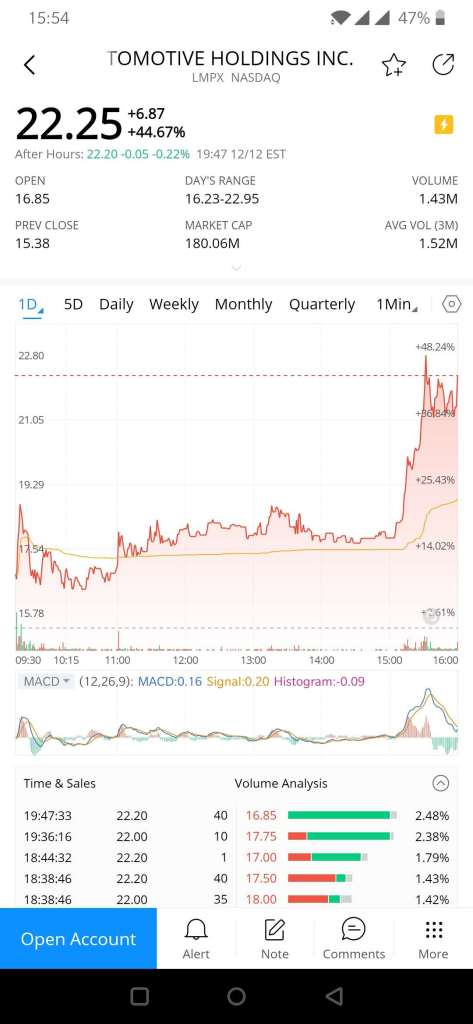

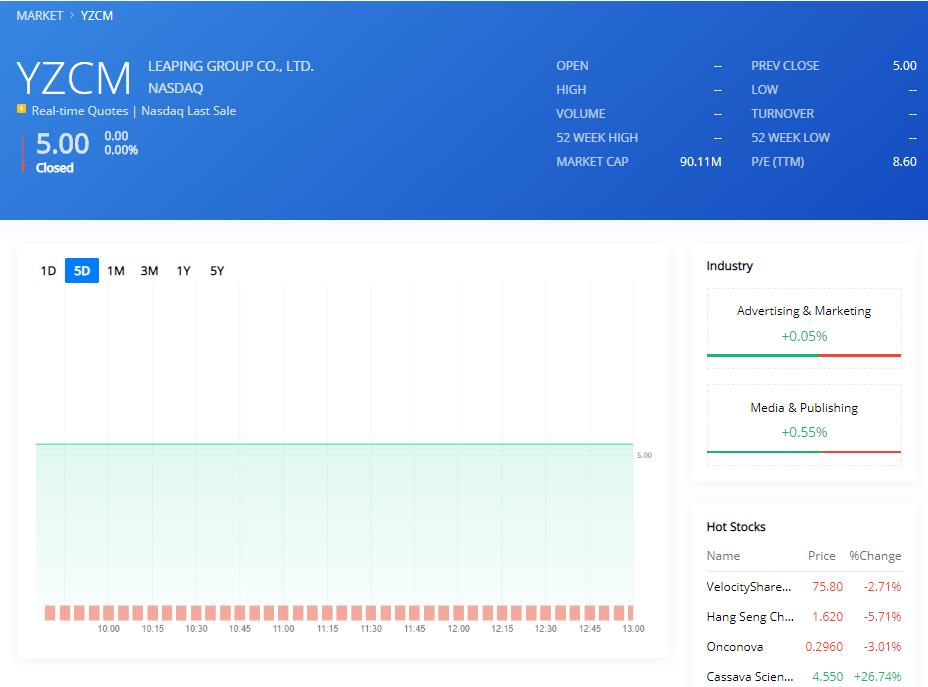

Webull official website is capable of providing the latest yzcm stock and trends and other relevant information about your interested stocks.Leaping Group Co., Ltd. (NASDAQ: YZCM) will issue 4 million shares at $5 Thursday on the Nasdaq. The offering represents about 20% of outstanding shares and is expected to raise about $20 million. China’s multimedia service provider facilitates advertising, event planning and film production.